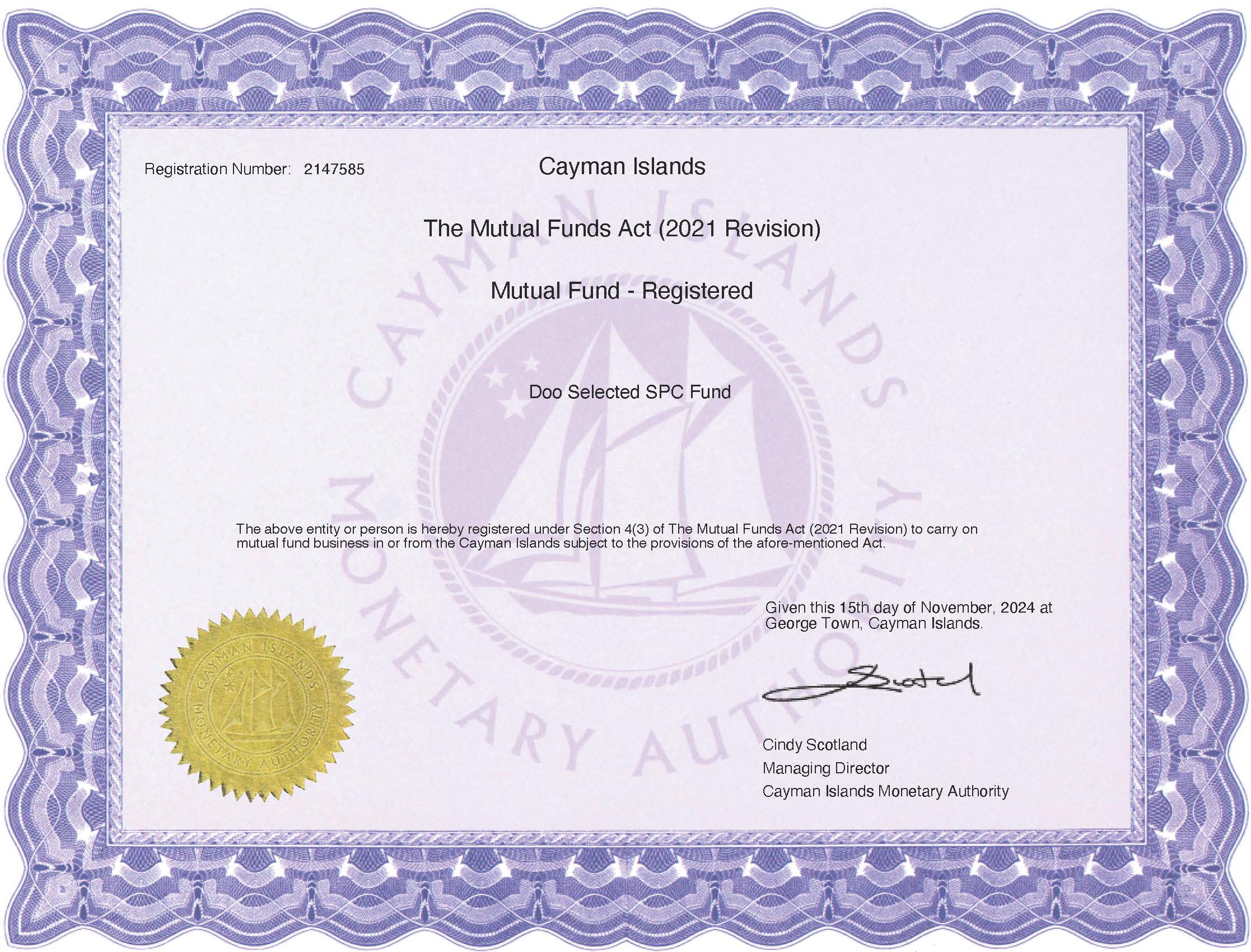

Recently, Doo Selected SPC Fund, an operating entity under Doo Group’s online brokerage brand, Doo Financial, has been granted a Registered Mutual Fund License (Registration Number: 2147585) by the Cayman Islands Monetary Authority (CIMA). This achievement lays a solid foundation for further expansion into the financial market.

CIMA Registered Mutual Fund License

The Cayman Islands is a globally renowned offshore financial center. With its flexible offshore financial environment and favorable tax policies, it has become a popular destination for fund registration. The region’s primary regulatory authority, the Cayman Islands Monetary Authority (KY CIMA), was established on January 1, 1997. The KY CIMA is responsible for regulating and supervising financial services entities operating within or from the Cayman Islands, as well as overseeing the issuance and exchange of the Cayman Islands’ currency.

The CIMA Registered Mutual Fund License is not only a testament to a financial institution’s compliance, capital strength, and risk management capabilities but also serves as an important getaway for many financial institutions and investment funds to enter the international market.

Thanks to its outstanding performance across various aspects, Doo Financial’s entity, Doo Selected SPC Fund, has successfully secured the Registered Mutual Fund License from the CIMA. Building on this milestone, Doo Selected SPC Fund is poised to expand its presence in the international market, leveraging enhanced transparency and flexibility to unlock broader opportunities.

Asset Protection and Risk Segregation

Doo Selected SPC Fund is a Segregated Portfolio Company (SPC) that operates with protected cells or investment portfolios. As an SPC, it enables the legal and financial segregation of assets for different investors or business units, providing holders of Segregated Portfolio (SP) shares with the opportunity to allocate capital across multiple independent portfolios. This structure offers investors a risk-isolation mechanism, ensuring their investments are shielded, to a certain extent, from adverse events affecting the SPC or other investors.

Due to the independence of assets and liabilities, SPCs have become a highly popular fund vehicle in the Cayman Islands. By consolidating multiple Segregated Portfolios (SPs) within a single legal entity, SPCs can also effectively reduce management and operational costs. This structure is particularly well-suited for fund managers seeking to manage multiple investment strategies and asset classes on a unified platform.

Strategic Global Expansion

In compliance with CIMA’s oversight, Doo Selected SPC Fund is authorized to offer flexible management of mutual funds while managing risks and seizing potential investment opportunities in the international market. As the online brokerage brand of Doo Group, Doo Financial will seize this opportunity to strengthen its reputation and influence in the international financial market, delivering enhanced services to its clients.

The approval of the license marks a significant milestone in the group’s global expansion strategy. We are now able to offer our clients a competitive edge in the international offshore financial hub of the Cayman Islands. This year, Doo Group’s entities have successfully obtained 10 new licenses, continuing to expand our global business while adhering to high compliance and operational standards. Moving forward, we will provide our clients with safer and higher-quality financial services while continuing to explore new market sectors.

Doo Financial Cyprus Limited Obtains License from the Cyprus Securities and Exchange Commission (CySEC)

Doo Financial Cyprus Limited Obtains License from the Cyprus Securities and Exchange Commission (CySEC)