Doo Group affiliate, Doo Prime introduces a new trading terminal – TradingView, a trading terminal where one-click trading order can be executed in seconds. TradingView offers up to ten thousand of real-time interactive charts, with more than a hundred of technical analysis indicators that supports you, in taking insightful trading decisions.

TradingView provides comprehensive chart analysis tools for 10,000+ websites. Its robust functions and easy-to-operate interface are popular with millions of traders around the world.

With this successful launch and integration, Doo Prime’s clients can seamlessly access Doo Prime TradingView by logging in to the user center through Doo Prime’s official website. Clients can now conveniently get a hold of analysis charts and real-time data of 6 major markets. This includes securities, futures, forex, precious metals, commodities, stock indexes, and up to 10,000+ CFD products.

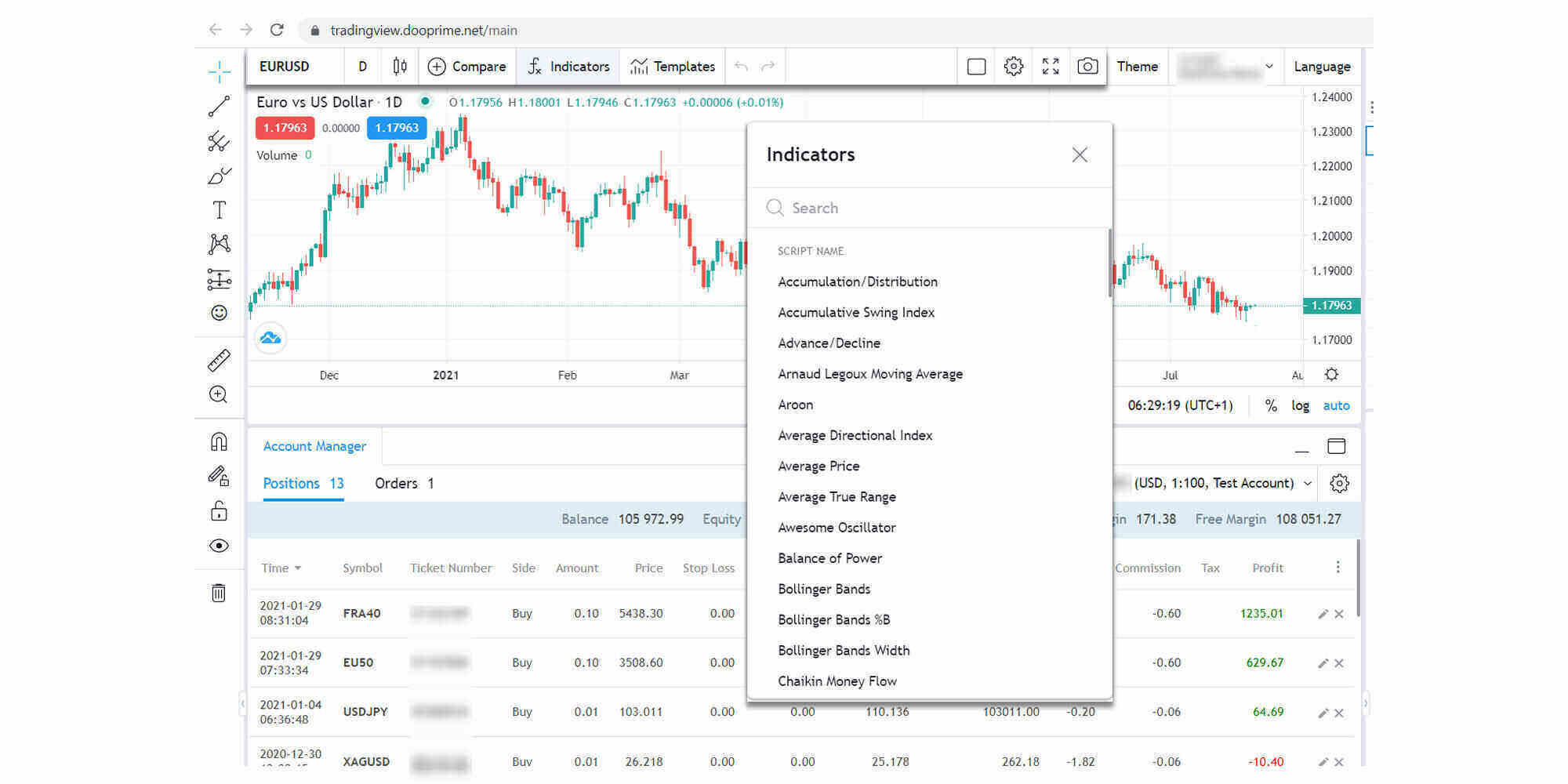

In addition, analysing and observing visualised market trends can be done in ease. This is made possible with the advantageous functions of adding more than 100 technical indicators without upper limit, while viewing the market depth of each product. Through this, clients are able to formulate and execute the most desirable trade with the best buying and selling price at the right timing.

On the whole, traders are required to create a TradingView account first, and then link a personal and compatible trading account with the platform before they can trade.

With Doo Prime TradingView, clients who wish to utilise this technology are not required to apply for an additional account, install complicated devices, nor pay any additional fees.

All of Doo Prime’s clients can enjoy both TradingView’s chart analysis tools and Doo Prime trading services, anytime, anywhere. Which means, clients can take advantage in carrying out research and analysis to meet your personal trading needs in all aspects!

4 Key Features of TradingView

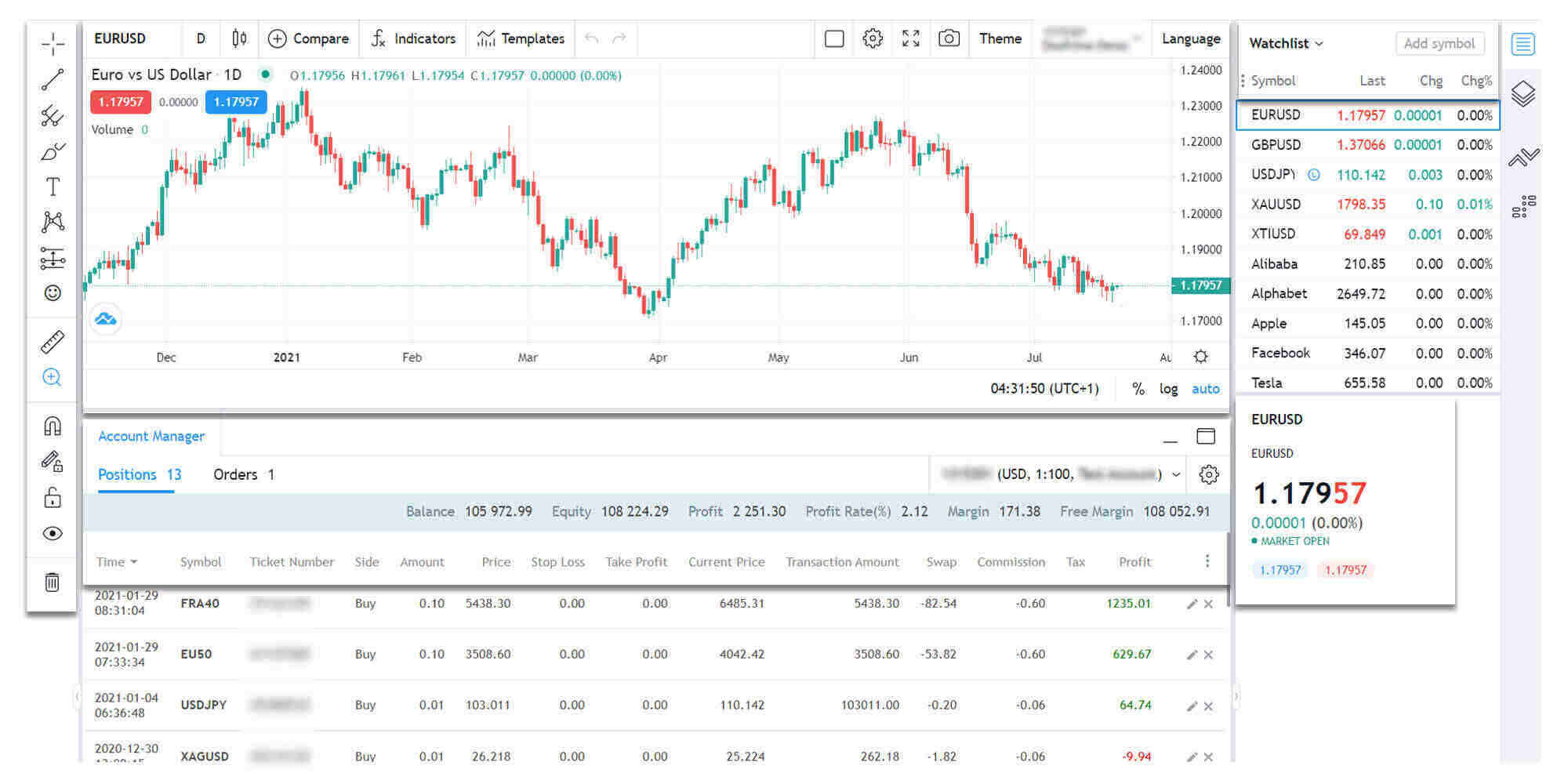

A. Personalised Settings

Through the function keys on the upper left, users can select candle charts of various trading levels and periods, compare the price trends of different trading varieties, and add technical analysis indicators. The upper right provides a total of three language options: simplified Chinese, traditional Chinese and English.

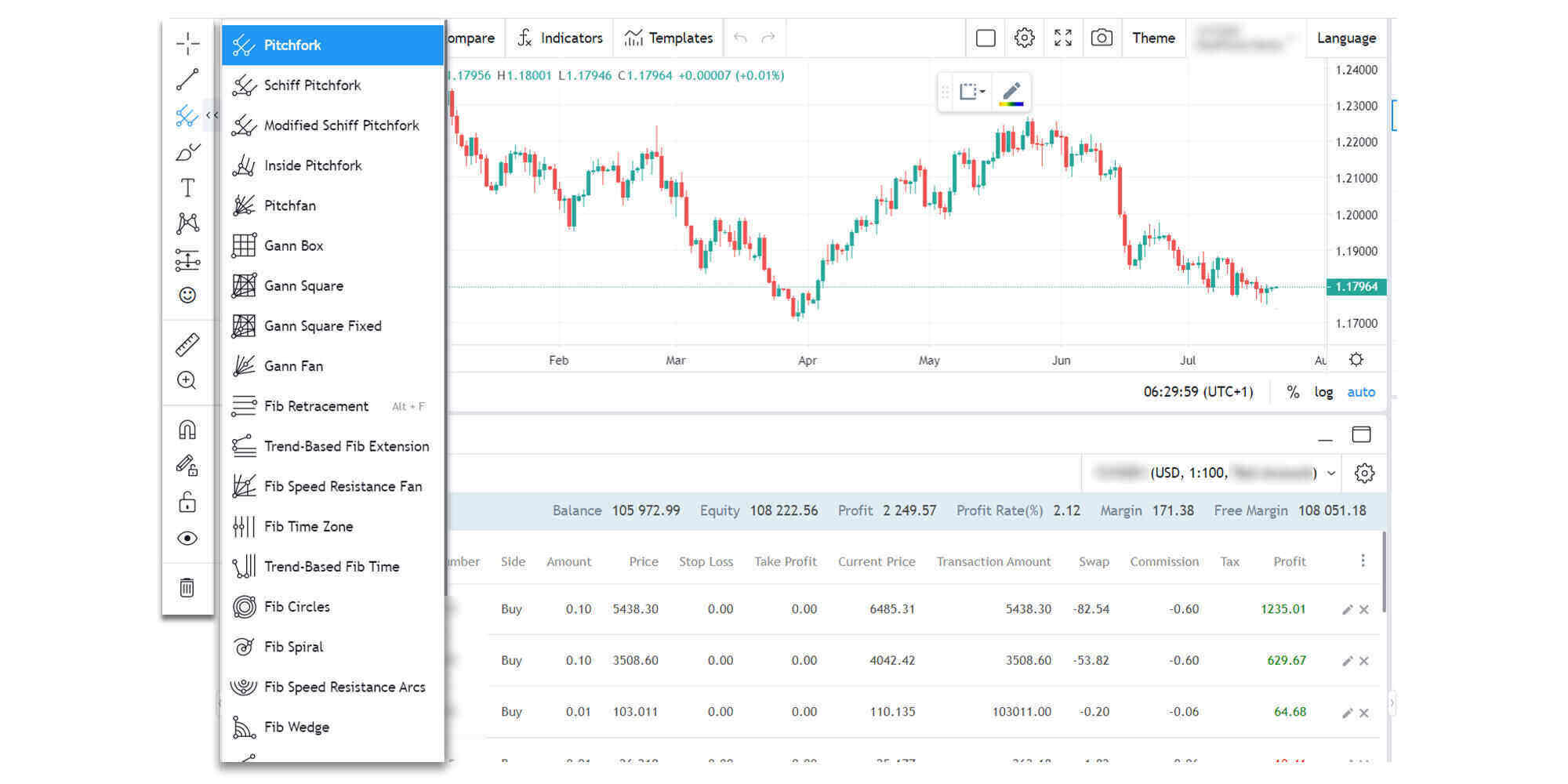

B. Intelligent Drawing Tools

The navigation column on the left provides a variety of drawing and measurement tools, including trend lines, Gann boxes, Fibonacci retracements, ABCD patterns, Elliott triangle waves and other geometric shapes commonly utilised by traders.

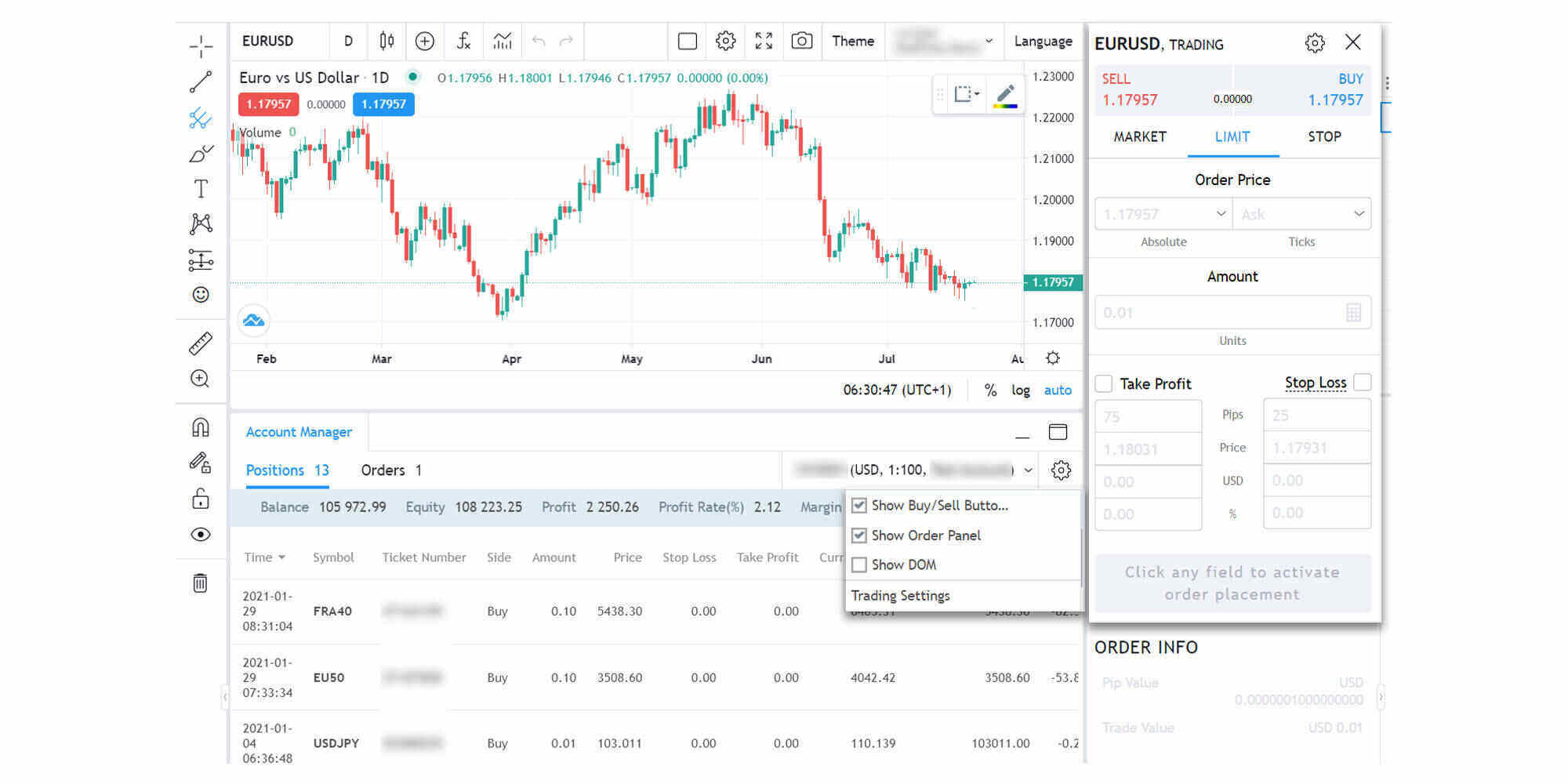

C. Advantageous Trading Settings

After turning on the “Show Buy/Sell Button” function, users can click on the quotation at the top left of the chart to quickly place an order. Turn on the “Show DOM” function to view the market depth of the trading product. There is also a “hot list” on the right side of the trading panel, allowing users to easily access the trading varieties of their choice.

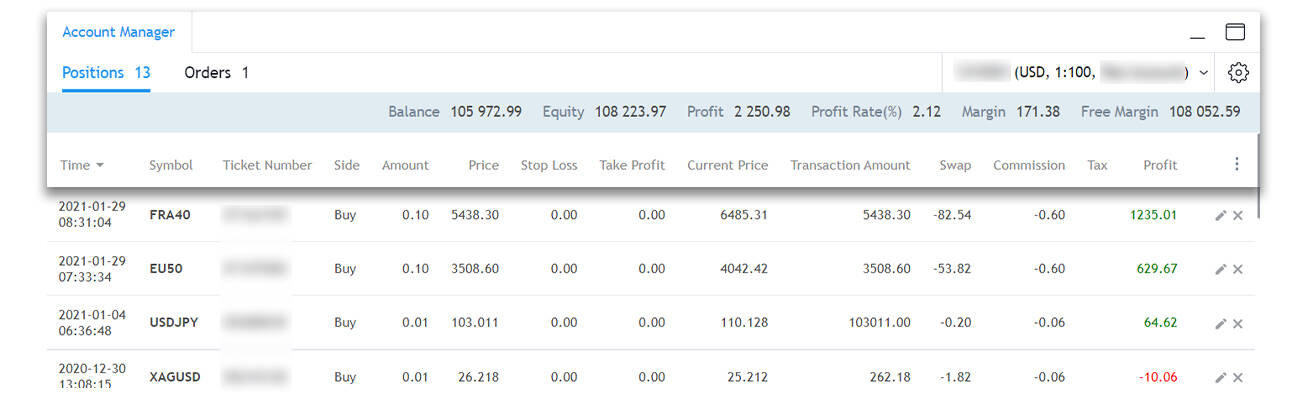

D. Comprehensive Account Manager

Immerse in a distinctive display of the account balance and margin level, as well as the variety, quantity, current price, position profit and loss, inventory fees and handling fees involved in each transaction. This section also shows the profit and loss changes of the account at a glance.

How to access the Doo Prime TradingView trading terminal?

1.Head to Doo Prime’s User Center page. Log in to your personal account by entering your email/mobile phone number and password.

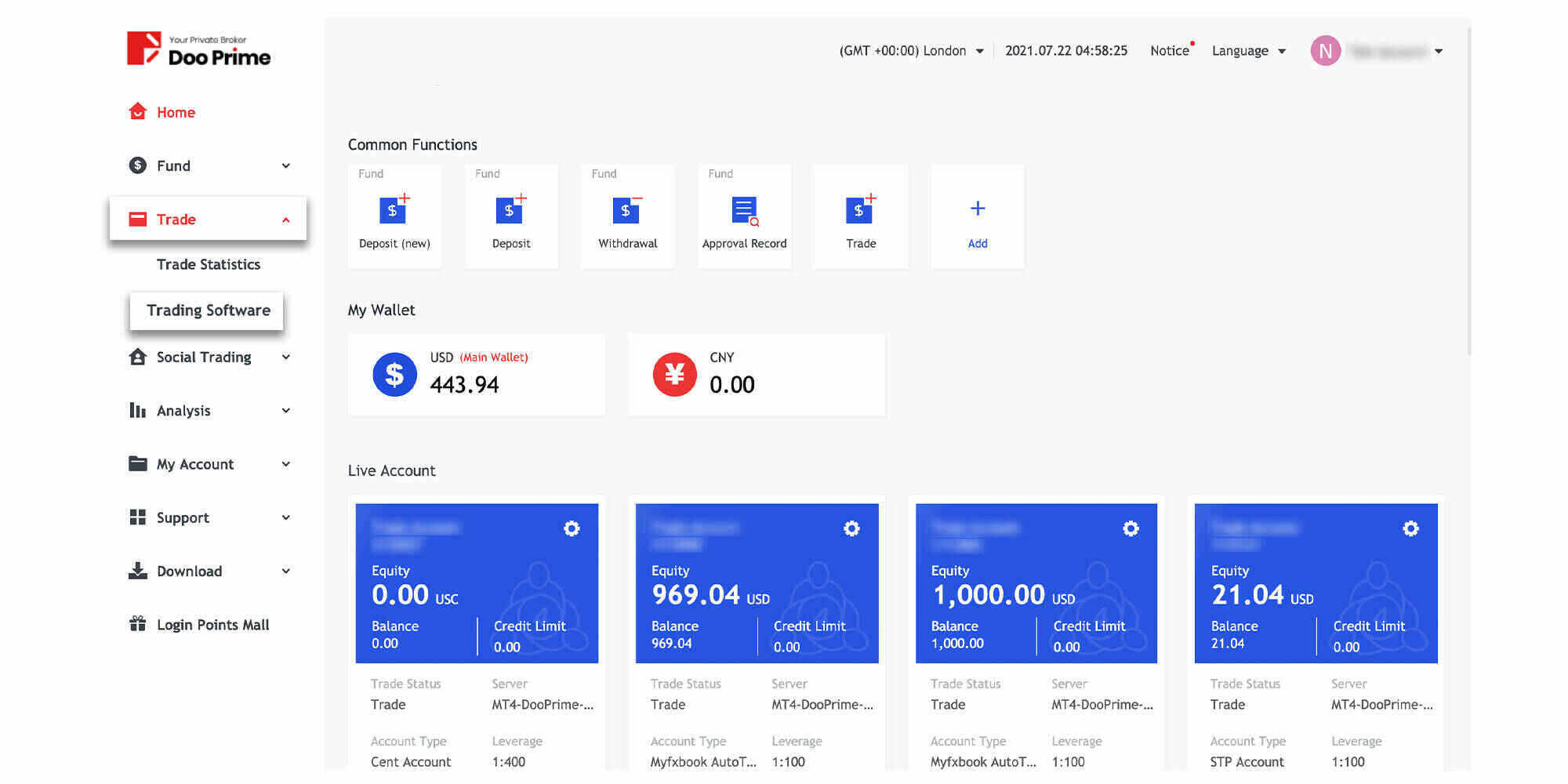

2. At the side bar located on your left, click on “Trade” and select “Trading Software” to find the TradingView option.

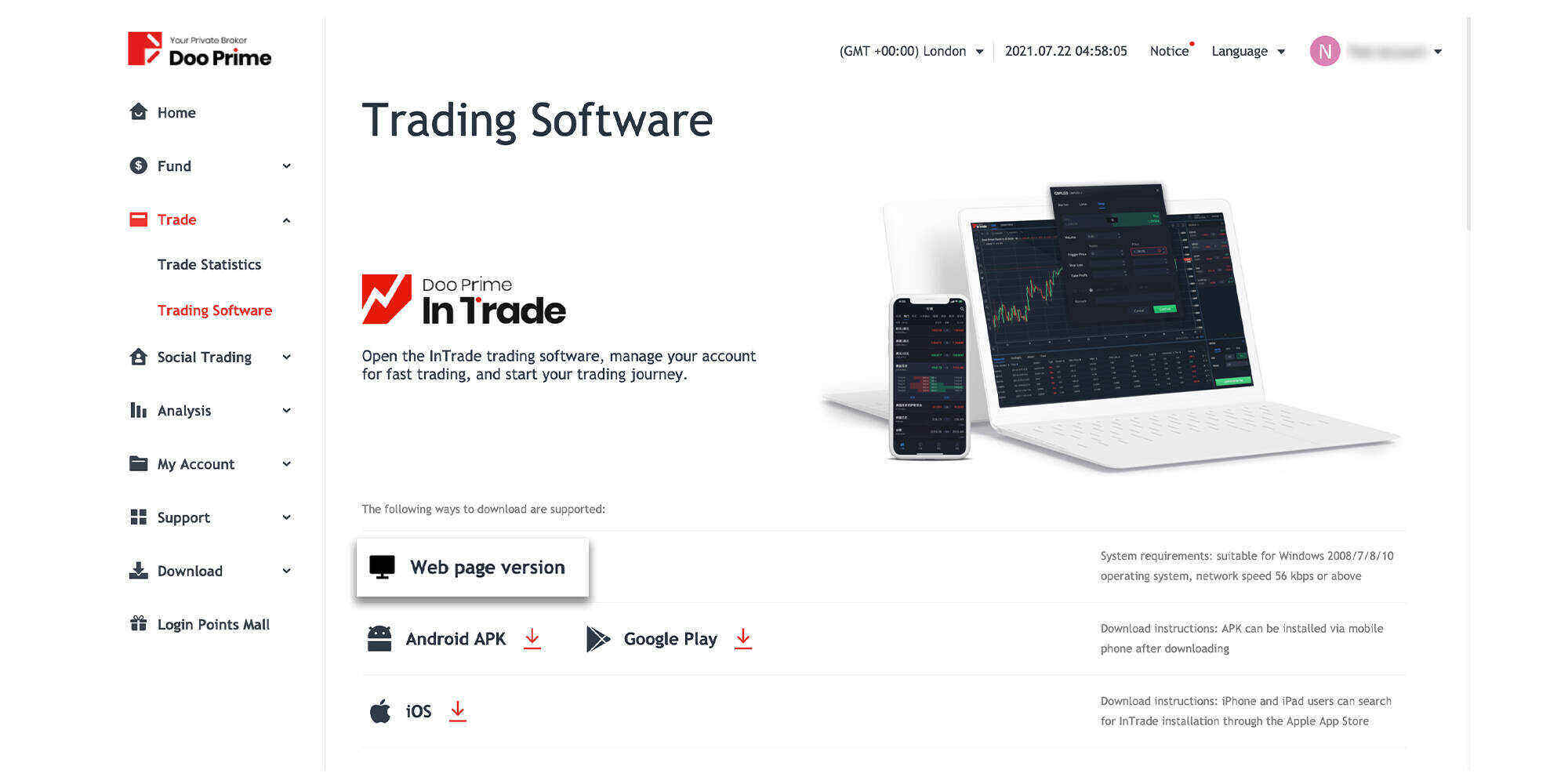

3.Once you have been redirected to the page, clickon “Web page version” to access the TradingView trading terminal and luxuriate in a brand-new trading experience.

The Doo Prime TradingView trading terminal integrates analysis and trading functions, which will undoubtedly facilitate users to get ahead of others on the trading road.

Log in now or sign up as a Doo Prime client and discover more of the robust features of Doo Prime TradingView for yourself!

About Doo Group

Established in 2014, Doo Group is headquartered in Singapore. After years of development, the Doo Group has become a large fintech-motivated financial service group, comprised of affiliates including Doo Clearing, Doo Financial, Doo Prime, and Doo Tech.

The Doo Group is committed to serving individual and institutional customers around the world with innovative trading brokerage services for securities, futures, CFDs (Contract For Differences), and other financial products.

Currently, some of the legal entities under Doo Group are regulated by financial regulators around the world, including the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), the UK Financial Conduct Authority (FCA), the Mauritius Financial Services Commission (MFSC) and the Vanuatu Financial Services Commission (VFSC), with operating centres located in Dallas, London, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other places.

Visit us at www.doogroup.com

For enquiries and further information, please contact us:

Hong Kong: +852 6701 2091

Email: [email protected]

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.

Doo Group Reports Record Trading Volume in January 2025

Doo Group Reports Record Trading Volume in January 2025