July 2021 Trading Volume Overview

- Total trading volume: US$27.48 billion

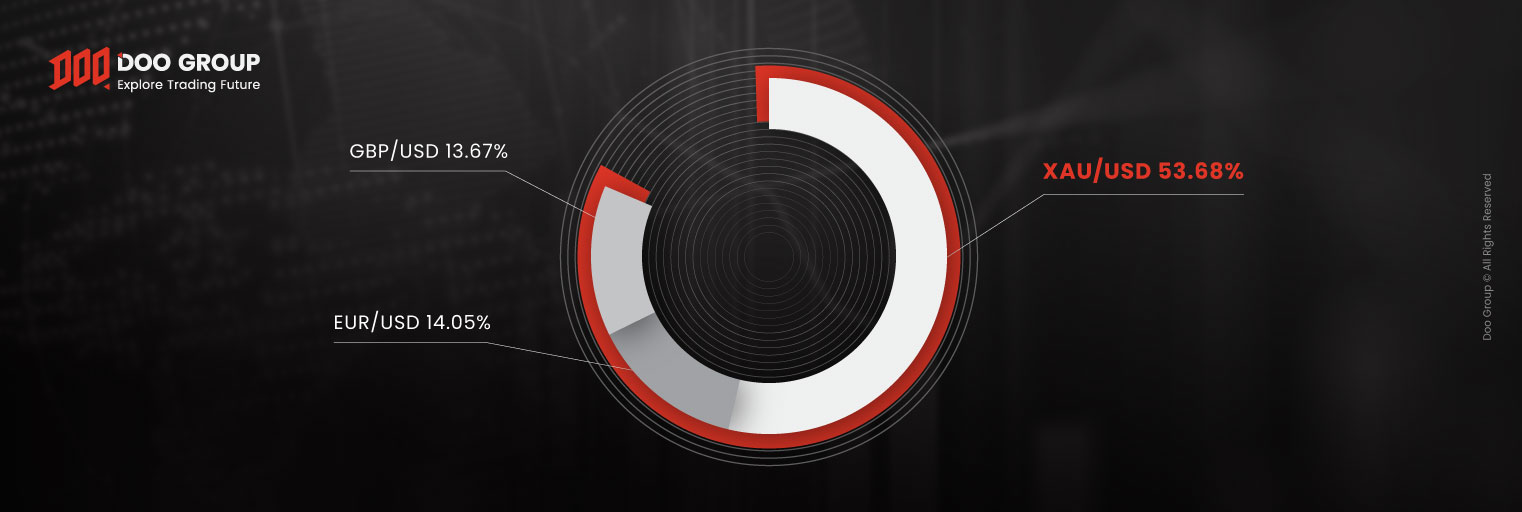

- Most popular currency pairs of traders: XAU/USD, EUR/USD, and GBP/USD

- XAU/USD recorded a total traded of US$14.75 billion

- AUD/USD posted the highest increase of 105.79% (+US$690.81 million)

The Doo Group, a financial services group with cutting-edge technology and solutions, reports a trading volume statistic of US$27.48 billion for July 2021.

With those figures, Doo Group’s total volume traded for the year-to-date of 2021 is valued at US$163.96 billion.

July 2021’s number sees a slight decrease of 13.88% when compared to the reported June 2021 trading volume.

However, when compared to July’s number last year, the Group displays an unprecedentedly strong and record pace with an increase of US$13.45 billion, or 95.87%. For July’s trading volume last year, the Group recorded a trading volume of US$14.03 billion.

Doo Group has been reporting positive growth in its trading volume since February 2021. Though there was a slight decrease last March and June, the trend is still going strong. May 2021’s number still remains as the highest traded month up to date, for the year.

This number is a total of trading volumes from the Group’s affiliates, Doo Clearing, which is a London-based FCA-regulated liquidity provider, and Doo Prime, a leading global online broker.

According to the latest numbers, XAU/USD, EUR/USD, and GBP/USD remain the leading choice of traders. It took up 81.4% of the total trading volume in July 2021.

In addition, XAU/USD recorded a total of US$14.75 billion of the overall monthly trading volume. Another one of the strongest pairings is the EUR/USD and GBP/USD, which recorded US$7.62 billion of the overall monthly trading volume.

Meanwhile, the AUD/USD pairing posted the highest increase in monthly trading volume, with US$690.81 million, or 105.79%.

While many factors contributed to this growth, there is no question that Doo Group continues to show strength in trading volume.

The Group will continue to create a global fintech system and lead the way to the new era of fintech-driven globalisation.

As a financial services group, Doo is committed to establishing a financial ecosystem network that empowers clients to stay one step ahead.

About Doo Group

Established in 2014, Doo Group is headquartered in Singapore. After years of development, the Doo Group has become a large fintech-motivated financial service group, comprised of affiliates including Doo Clearing, Doo Financial, Doo Prime, and Doo Tech.

The Doo Group is committed to serving individual and institutional customers around the world with innovative trading brokerage services for securities, futures, CFDs (Contract For Differences), and other financial products.

Currently, some of the legal entities under Doo Group are regulated by financial regulators around the world, including the US Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA), the UK Financial Conduct Authority (FCA), the Mauritius Financial Services Commission (MFSC) and the Vanuatu Financial Services Commission (VFSC), with operating centres located in Dallas, London, Singapore, Hong Kong, Dubai, Kuala Lumpur, and other places.

Visit us at www.doogroup.com

For enquiries and further information, please contact us:

Hong Kong: +852 6701 2091

Email: [email protected]

[Disclaimer]

This information is addressed to the general public solely for information purposes and should not be taken as investment advice, recommendation, offer, or solicitation to buy or sell any financial instrument. The information displayed herein has been prepared without any reference or consideration to any particular recipient’s investment objectives or financial situation. Any references to the past performance of a financial instrument, index, or a packaged investment product shall not be taken as a reliable indicator of its future results. Doo Group makes no representation and warranties to the information displayed and shall not be liable for any direct or indirect loss or damages as a result of any inaccuracies and incompleteness of the information provided. Doo Group shall not be liable for any loss or damages as a result of any direct or indirect trading risks, profit, or loss associated with any individual’s investment.

Doo Group Reports Record Trading Volume in October 2023

Doo Group Reports Record Trading Volume in October 2023